Calculator Tutorials

This interest is paid by the bond issuers where it is being calculated annually on the bonds face value, and it is being paid to the purchasers. Usually, the coupon rate is calculated by dividing the sum of coupon payments by the face value of a bond. Bonds are issued by government and companies in order to raise capital to finance their operations. So, coupon rate is the amount of yield paid by the issuer to their purchasers, but it is a certain percentage amount calculated on the face value.

The interest rate is the amount charged by the lender from the borrower, which is calculated annually on the amount that has been lent. The interest rates are being affected with change in the market scenario. The interest rate does not depend on the issue price or market value; it is already being decided by the issuing party. The market interest rates have effects on the bond prices and yield, wherein the increase in the market interest rates will reduce the fixed-rates of the bond.

- Find an Advisor.

- bond coupon yield to maturity!

- Understanding bonds.

- The Relationship Between Bonds and Interest Rates- Wells Fargo Funds.

- lafata cabinets coupon!

- Types of Bonds.

- Bond Terminology.

Shorter maturity of the bond reduces the coupon rate. Longer maturity duration increases the interest rates which affects the interest amount.

Understanding the Different Types of Bond Yields

Shorter maturity duration reduces the risk of interest rates. Types Coupon can be of two types Fixed rate and Variable rate. Fixed rate does not change and fixed till maturity while the variable rate changes every period. Interest rate does not have any types and is fixed until the regulatory body decides to change it.

Final Thought If the investor intends to hold the bond to maturity, the day to day fluctuations in the bonds price may not be that important. The bonds price will change but the stated interest rate will be received. On the other hand, instead of holding the bonds until maturity the investor can sell the bond and reinvest the money or the proceeds into another bond that pays a higher coupon rate. This has been a guide to the Coupon Rate vs Interest Rate. Here we discuss the top differences between Coupon Rate vs Interest Rate along with infographics and comparison table.

FINRA Utility Menu

You may also have a look at the following articles —. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Free Investment Banking Course.

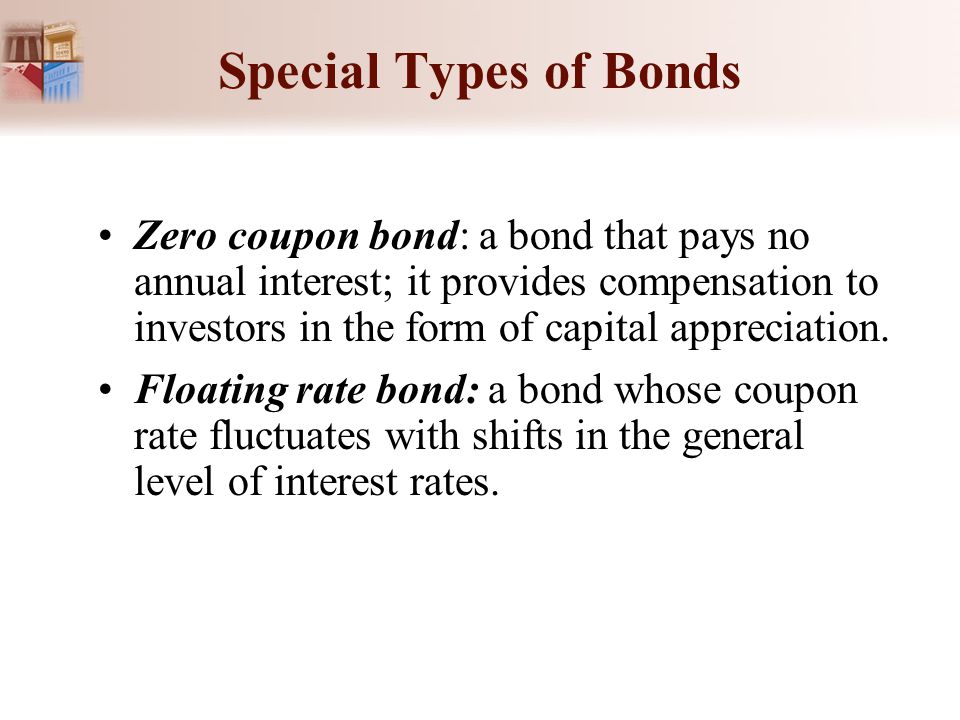

Login details for this Free course will be emailed to you. Free Accounting Course. Convertible bonds may be converted into shares of another security under stated terms.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics)

Multi-tranche bonds offer bondholders several tiers of investments within the same issue. Typically, the tiers may vary in their targeted maturities and credit quality.

All information and opinions contained in this publication were produced by the Securities Industry and Financial Markets Association from our membership and other sources believed by the Association to be accurate and reliable. By providing this general information, the Securities Industry and Financial Markets Association makes neither a recommendation as to the appropriateness of investing in fixed-income securities nor is it providing any specific investment advice for any particular investor.

Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and sources may be required to make informed investment decisions. Types of Bonds Print.